Shareholder Returns

The Company recognizes that shareholder returns to the shareholders is an important management issue and will return profits to shareholders through dividends as well as through shareholder benefits.

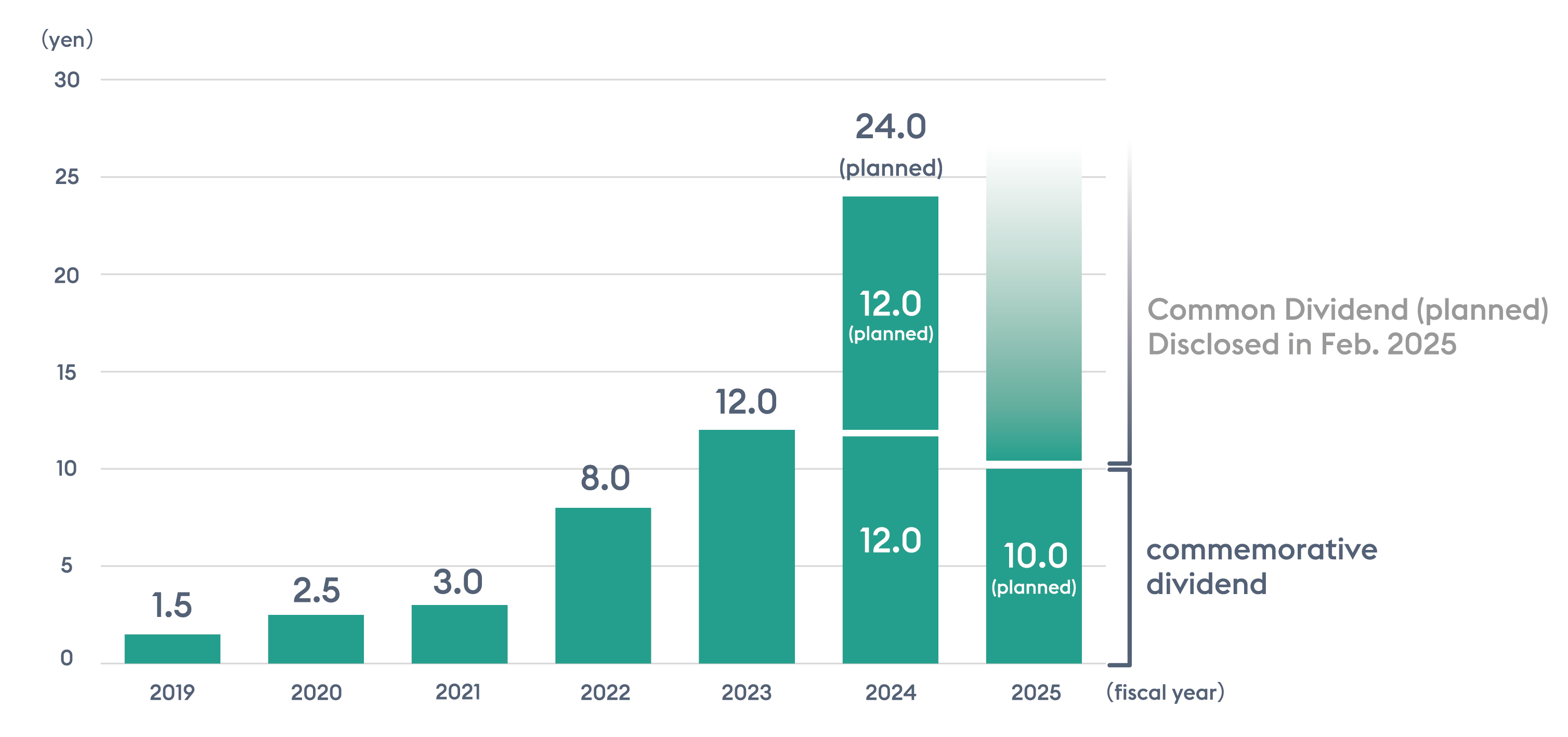

Dividends

The Company strives for medium- to long-term growth through maintaining stable dividends as principle and ensuring appropriate financial soundness based on a dividend payout ratio of 30% or more.

-

Dividends

-

Annual dividends

-

Fiscal year

Interim

Fiscal year-end

Other

2019

-

1.5 yen

2020

-

2.5 yen

2021

-

3.0 yen

2022

-

8.0 yen

2023

-

12.0 yen

2024

12.0 yen

12.0 yen

2025

12.0 yen

14.0 yen

10 yen (commemorative dividend) (planned)

Acquisition of Treasury Shares

Along with dividends, the Company will actively repurchase its own shares, taking into consideration stock market trends, capital efficiency, and other factors.

-

Status of Acquisition of Treasury Shares

-

Acquisition period

Acquisition method

Number of shares acquired

Amount

(thousands of yen)December 23, 2024 to March 13, 2025

Open market purchase

401,300

499,947

November 18, 2024 to December 19, 2024

Open market purchase

363,900

499,875

March 25, 2024 to May 31, 2024

Open market purchase

1,202,700

999,946

November 6, 2023 to November 22, 2023

Open market purchase

619,600

499,975

May 12, 2023 to August 25, 2023

Open market purchase

1,884,600

1,499,960

August 8, 2022 to October 17, 2022

Open market purchase

1,088,400

999,958

August 10, 2021 to August 31, 2021

Open market purchase

220,000

182,420